| What’s this blog about? |

| This blog covers the growing concern of chargebacks in eCommerce and introduces Bankful’s Rapid Dispute Resolution (RDR) as a solution. It explains how RDR helps merchants manage disputes proactively by automatically processing refunds before they escalate into chargebacks, thus preventing financial losses and protecting merchant accounts. The blog highlights the rising issue of chargebacks, with statistics on their costs and impact, and outlines the key benefits of RDR, such as reducing operational costs, improving customer satisfaction, and protecting merchant reputations |

Chargebacks and disputes are a growing concern for businesses operating in eCommerce. A chargeback occurs when a customer disputes a transaction and their bank forcibly reverses the charge. While chargebacks were initially designed to protect consumers from fraud, they have become a costly and operationally challenging issue for merchants. Excessive chargebacks can lead to financial losses, increased fees, and even the potential loss of a merchant account.

To help businesses navigate this challenge, Bankful has introduced Rapid Dispute Resolution (RDR)—a proactive and automated system designed to prevent chargebacks before they occur. This blog will provide an in-depth look at RDR, how it works, its benefits, and how businesses can implement it to enhance their dispute management process.

A chargeback is a transaction reversal initiated by a bank or credit card issuer, usually due to a dispute between a customer and a merchant. When a customer challenges a transaction (e.g., due to fraud, dissatisfaction with the product, or unauthorized charges), the bank may refund the amount to the customer and charge it back to the merchant's account.

Understanding Rapid Dispute Resolution (RDR)

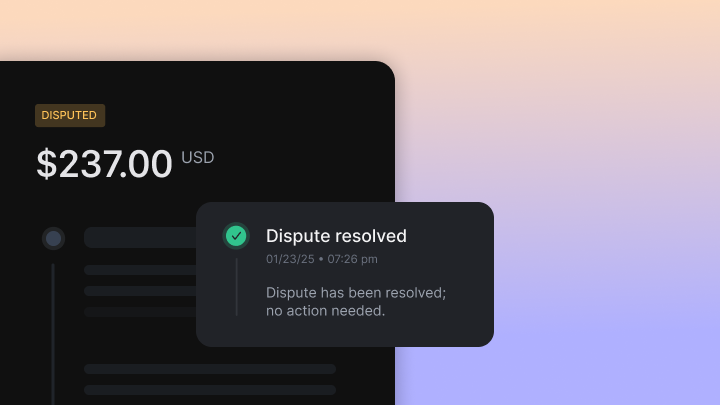

RDR is an automated solution that helps merchants manage disputes by proactively resolving them before they escalate into chargebacks. It allows merchants to set predefined rules that automatically refund disputed transactions based on specific criteria. This process ensures that disputes are addressed swiftly, reducing the likelihood of chargebacks and preserving the merchant’s chargeback ratio.

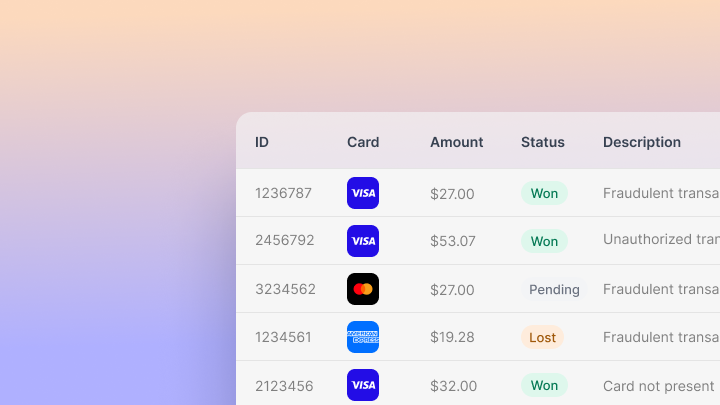

When a customer files a dispute, RDR intervenes before the chargeback is officially recorded. Instead of going through the lengthy and often expensive chargeback process, the system evaluates the dispute based on merchant-defined parameters, such as:

- Transaction amount

- Dispute reason code

- Customer history and transaction risk level

If the dispute meets the pre-set criteria, the system automatically processes a refund, preventing the chargeback from occurring. This not only saves merchants from chargeback fees but also enhances customer satisfaction by providing quick resolutions.

The Rising Problem of Chargebacks in eCommerce

Chargebacks have become a significant concern for online businesses. According to industry data:

- The average chargeback ratio for merchants is between 0.5% and 1% of total transactions.

- Chargeback fees can range from $20 to $100 per dispute, even if the merchant wins the case.

- Friendly fraud (when a customer falsely claims fraud or non-receipt of goods) accounts for over 60% of chargebacks.

- Excessive chargeback ratios can lead to higher processing fees or even termination of merchant accounts by payment processors.

Given these alarming statistics, merchants must adopt proactive chargeback prevention strategies—and RDR offers a seamless way to achieve this.

cost to merchant for chargeback fee

are from a customer falsely claiming fraud

cost to merchants in the US from chargebacks

Key Benefits of Bankful’s Rapid Dispute Resolution (RDR)

1. Prevents Chargebacks Before They Happen

The biggest advantage of RDR is that it stops disputes from escalating into chargebacks. Since chargebacks can hurt a merchant’s standing with payment processors, preventing them proactively can maintain the business’s credibility and ensure smooth payment processing.

2. Reduces Operational Costs

Each chargeback comes with fees, potential penalties, and lost revenue. The time spent disputing chargebacks also translates into operational costs. By automating dispute resolution, RDR eliminates these inefficiencies and lowers costs associated with chargeback management.

3. Improves Customer Satisfaction

Customers may dispute transactions for various reasons, including unclear refund policies, unrecognized transactions, or dissatisfaction with the product. By using RDR, merchants can offer instant refunds for legitimate disputes, fostering goodwill and trust with customers instead of engaging in a lengthy dispute process.

4. Protects Merchant Reputation and Payment Processing Standing

Merchants with high chargeback ratios risk being labeled as high-risk merchants by banks and payment processors. This can lead to higher processing fees or account suspensions. RDR ensures that businesses maintain a healthy chargeback ratio, protecting their ability to process payments effectively.

5. Enhances Fraud Prevention

RDR allows merchants to identify patterns of friendly fraud and recurring disputes. By analyzing dispute trends, businesses can adjust their fraud prevention strategies and customer service policies to further reduce disputes in the future.

How to Implement Bankful’s RDR for Your Business

Implementing RDR is a straightforward process, and Bankful provides full support to help merchants integrate this solution. Here’s how businesses can get started:

Step 1: Define Your Dispute Resolution Rules

Merchants can customize the RDR system by setting up rules that determine which disputes should be automatically refunded. This includes:

- Transaction value thresholds: Set a limit on refund eligibility (e.g., disputes under $50 get auto-refunded).

- Specific reason codes: Automatically approve refunds for certain dispute types, such as non-receipt of goods.

- Customer history: Prioritize refunds for first-time customers to encourage brand loyalty.

Step 2: Integrate RDR with Your Payment Processing System

Bankful’s RDR is designed to work seamlessly with your existing payment processing setup. Our team assists with the integration process, ensuring a smooth transition to automated dispute management.

Step 3: Monitor and Optimize Performance

Once RDR is active, merchants can track dispute trends, analyze why disputes are occurring, and refine their policies to further reduce chargebacks. The system provides real-time reporting and analytics, allowing businesses to make data-driven decisions to optimize their chargeback prevention strategy.

Best Practices for Reducing Disputes and Chargebacks

While RDR is a powerful tool for chargeback prevention, merchants should also adopt best practices to minimize disputes in the first place:

- Clear and Transparent Policies

- Provide detailed refund and return policies on your website.

- Ensure customers understand billing terms, especially for subscriptions or recurring payments.

- Strong Customer Support

- Offer multiple support channels (live chat, email, phone) for quick issue resolution.

- Respond to customer inquiries before they escalate into disputes.

- Fraud Prevention Measures

- Implement AVS (Address Verification System) and CVV checks to reduce unauthorized transactions.

- Use AI-based fraud detection tools to identify suspicious transactions.

- Proactive Communication

- Send order confirmation emails and shipping updates to keep customers informed.

- Use clear descriptors on credit card statements so customers recognize charges.

- Regular Chargeback Analysis

- Monitor chargeback trends to identify root causes.

- Adjust policies and customer service strategies accordingly.

Take Control of Disputes with Bankful’s RDR

Chargebacks can severely impact a business’s bottom line, but with Bankful’s Rapid Dispute Resolution (RDR), merchants now have a proactive and automated solution to prevent them. By resolving disputes before they escalate, businesses can protect revenue, maintain a healthy chargeback ratio, and enhance customer relationships.

If you’re ready to streamline your dispute management and safeguard your payment processing, apply for Bankful’s RDR service today and take charge of your business’s financial security.